estate tax law proposals 2021

Income and estate tax planning before a change in the law occurs. Distribution Tables by Dollar Income Class.

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

Tax Legislation in the 117th Congress The likelihood of candidate Bidens tax proposals becoming law will be dependent upon control of Congress in January 2021.

. Friday September 17 2021. Payment of the capital gains tax would secure the step up in basis at death. Key proposals in the estate planning realm that have been.

The current 2021 gift and estate tax exemption is 117 million for each US. The Biden Administration has proposed significant changes to the income tax system. Working Families Tax Relief Act.

The BBBA would further extend the CTC through 2025 and make permanent the DCTC. If a decedent were to die in 2021 with an estate of 11700000 there would be zero tax due on the estate and a full step up in tax basis on all assets to the value on the decedents date of death. As of January 1 2021 an individual may give up to 11700000 during life or at death without incurring any federal gift or estate tax.

What was considered a tax-free gift on December 31 2021 now becomes a taxable gift and incurs gift. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF PDF. Distribution of Current Law and Selected Tax Cuts Since 2001.

If the current split in control the House currently is controlled by the Democrats and the Senate. Reduction in Federal Estate and Gift Tax Exemption Amounts. 11580000 in 2020 11700000 in 2021 and 12060000 in 2022.

The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to income tax and estate and gift tax. November 16 2021 by Jennifer Yasinsac Esquire. Infrastructure and Your Estate Plan Could Take Up a Hefty Chunk of It.

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022. Summary of Proposed 2021 Federal Tax Law Changes. Following weeks of negotiations between President Joe Biden and congressional Democrats the White House released a retooled framework for the Build Back Better Act on October 28.

Proposed effective date is retroactive to January 2021. A reduction in the annual gift tax exemption from 15000 per person per donee to an annual per donor maximum of 20000 per year. On Sunday September 12 th the House Ways and Means Committee released a.

House Ways and Means Committee Proposal Lowers Estate Tax Exemption. November 03 2021. Capitol Hill Is Taking Big Measures to Fund the US.

Under current law the existing 10 million exemption would revert back to the 5 million exemption. The Estate Tax is a tax on your right to transfer property at your death. The tax reform proposals announced by the Administration in April and the General Explanations of the Administrations Fiscal Year 2022 Revenue Proposals published.

Since the beginning of 2021 we have heard about everything from President Joe Bidens 6 trillion American Families Plan to a potential 1 trillion bipartisan infrastructure bill. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. In September we posted on the sweeping tax changes proposed by The Ways and Means Committee of the House of Representatives.

Our Estate Planning Attorneys Explain. From Fisher Investments 40 years managing money and helping thousands of families. This year has brought many proposals to Congress that would dramatically change the tax implications for many farm businesses.

While there is still a lot of uncertainty at this point we do know that big changes are on the horizon. Estate Tax Watch 2021. For example a taxpayer is considering a gift of 117 million gift on January 1 2022.

Then the gift and estate tax exemption is lowered from 117 million to 6 million with the gift and estate tax rate increased from 40 to 45 all effective January 1 2022. President Biden has proposed major changes to the Federal tax laws some of which are sought to be effective earlier in 2021 ie we are already operating under these changes if they later become adopted as compared to the effective date the new tax law changes may be passed by Congress or a later. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025.

New federal tax legislation is on the horizon with significant changes for estate and gift taxes. Even if the proposed changes to the transfer taxes above do not become part of any new tax law the current increased exemptions for the federal estate gift and GST tax will automatically expire. 2021 Estate Tax Proposals.

By Laws Bills and Proposals. However on October 28 and then again on November 3 the House Rules. Note the tension in current year planning if this proposal is adopted.

For the last 20 years the battle over estate taxes has centered around the elimination of the estate tax and the accompanying step up in basis and the amount of the federal. Click to play an audio version of this article. Bidens Tax Proposals And Estate Planning.

Targeted at multimillionaires and billionaires this proposal imposes a new death tax on many families with long term investments. President Bidens Build Back Better plan currently wending its way through Congress. That could have potentially hit millions of middle-class Americans including elderly who own.

By Cona Elder Law. An investor who bought Best Buy BBY in 1990 would have a gain. Potential Estate Tax Law Changes To Watch in 2021.

The American Rescue Plan Act ARPA enacted in early 2021 temporarily expanded both the Child Tax Credit CTC and the Dependent Care Tax Credit DCTC. Fortunately the proposed law does not increase the estate tax rate the way that the Bernie Sanders bill would have. July 13 2021.

If Grandma does no gifting in 2021 and dies in 2022 or thereafter when the. Consumer IssuesConsumer Protection News and Events. 2021 Federal Estate and Transfer Tax Law Proposals.

The Wealth Advisor Contributor. The subject of taxes due at death has gained attention because President Biden proposed in April 2021 eliminating the so-called step-up in basis for gains above 1 million or 2 million per couple and making sure the gains are taxed if the property is not donated to charity.

Democrats Introduce Tax Proposals Newsletters Legal News Taxation Foley Lardner Llp

Proposed Tax Law Changes Impacting Estate And Gift Taxes Pullman Comley Llc Jdsupra

Proposals Sample Proposals Sample Business Plan Business Proposal Sample Proposal Sample

Free Purchase Bid Short Form Form Printable Real Estate Forms Real Estate Forms Lettering Reference Letter

House Democrats Tax On Corporate Income Third Highest In Oecd

Proposed Legislation To Change Estate And Gift Tax Planning Stoel Rives Llp Jdsupra

Status Of Cadre Review Proposals Processed In Dopt As On 30th April 2021 Proposal Word Building Enterprise Development

Watch Mail For Debit Card Stimulus Payment Prepaid Debit Cards Debit Card Visa Debit Card

Inflation Adjustments For 2021 Business Tax Deductions Business Tax Irs

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Pass Through Entity Owners Bear The Hit With Proposed Federal Tax Law Changes

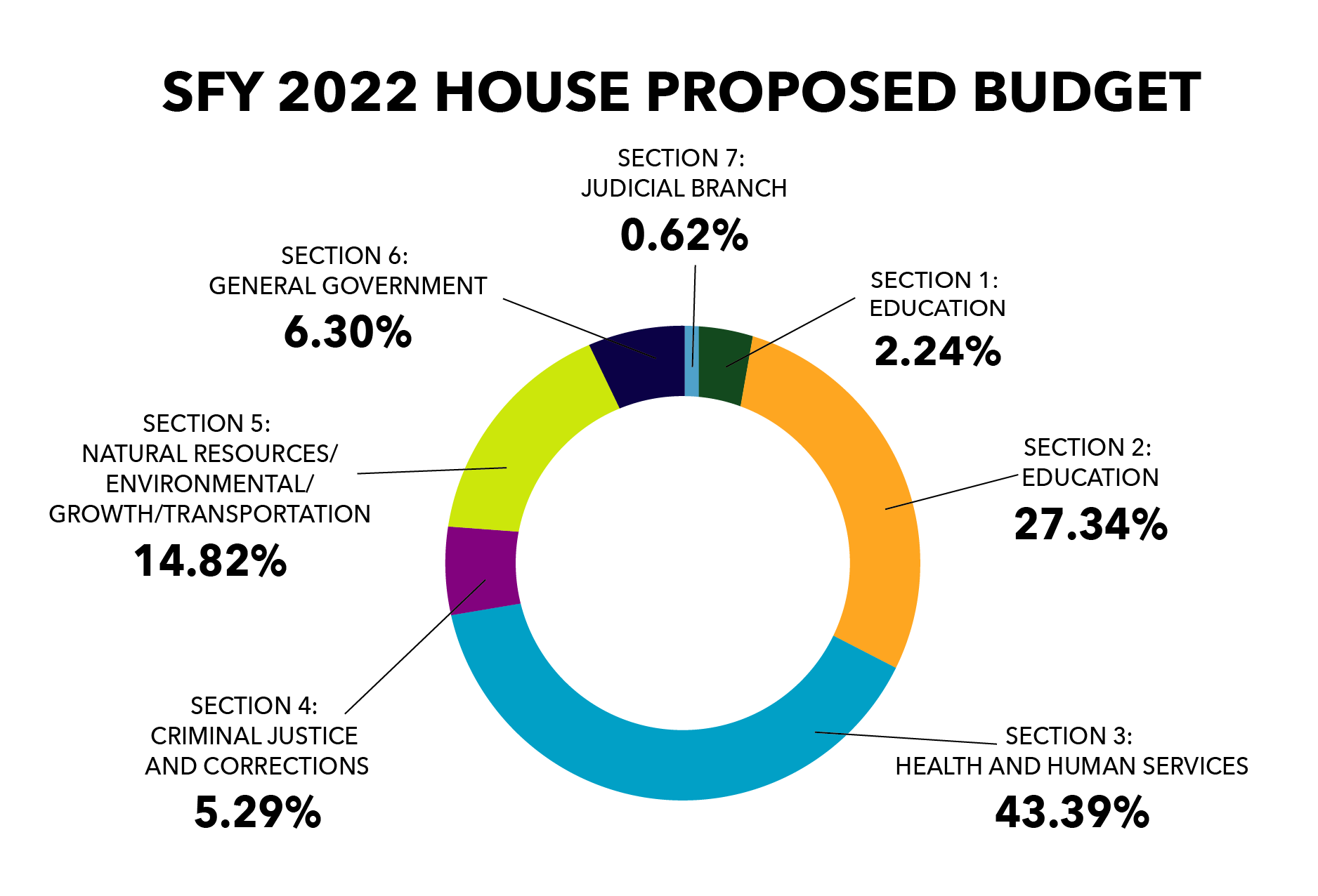

House Senate Proposed Budget 2021 2022 Florida Association Of Counties

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

The New Death Tax In The Biden Tax Proposal Major Tax Change

What Can The Wealthy Do About Biden S Proposed Tax Increases

Current Status Of Federal Estate And Gift Tax Proposals Ruder Ware Jdsupra

Printable Sample A Letter Of Intent Form Business Letter Sample Letter Of Intent Letter Example

Partnership Agreement Template 01 Letter Of Intent Throughout Template For Business Partnership Agreement Letter Of Intent Contract Template Word Template